What FiberSeeker and Snapmaker Kickstarter Data Reveals About the Global 3D Printing Market

Kickstarter has become a recurring launch platform for desktop and professional 3D printing systems. However, campaign results are often discussed only in terms of total funds raised. A closer look at country-level backer distribution reveals far more about product positioning, market maturity, and long-term business realities.

By comparing the Kickstarter country distribution of FiberSeeker and Snapmaker, two fundamentally different 3D printing brands, we can extract meaningful insights into how the global additive manufacturing market behaves.

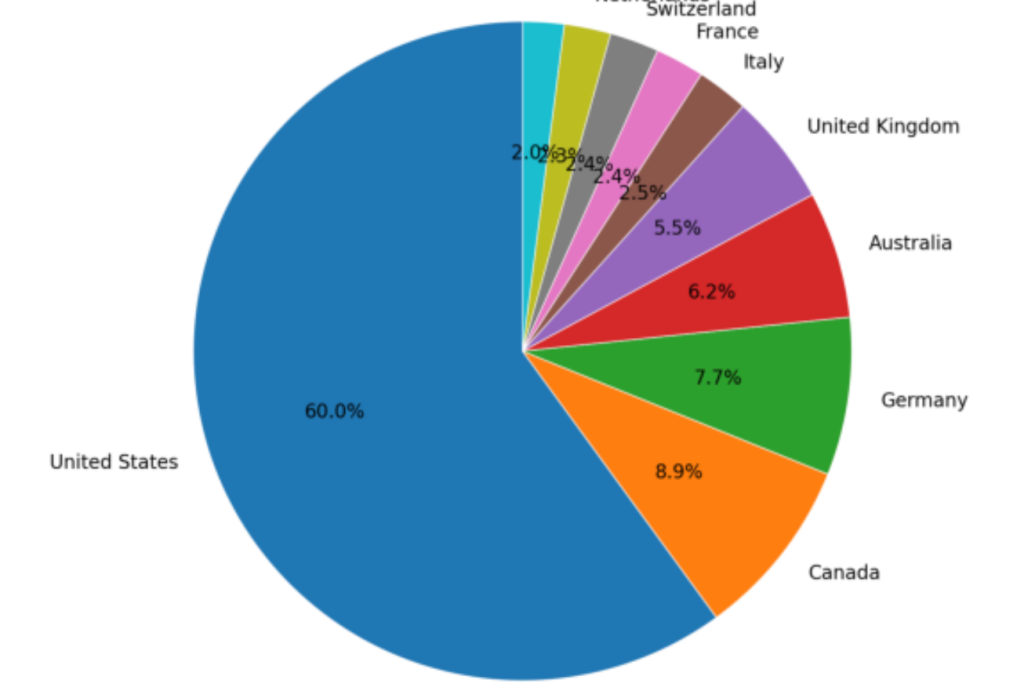

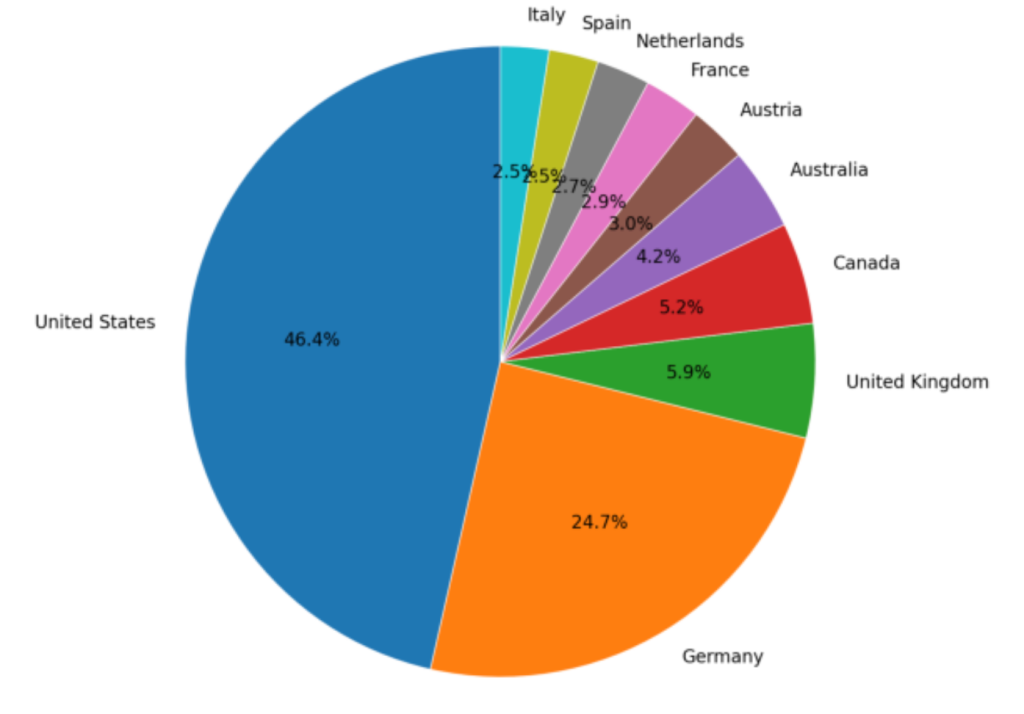

Backer Distribution at a Glance

FiberSeeker – Top Backer Countries

Snapmaker – Top Backer Countries

The numerical gap is substantial, but the difference is structural rather than accidental.

Why the Results Are So Different

Product Positioning Defines the Market Size

Snapmaker is primarily a 2C / prosumer-oriented platform. Its modular design, broad functionality, and strong brand storytelling appeal to hobbyists, makers, educators, and small studios. This creates a large addressable customer pool from day one.

FiberSeeker, by contrast, is positioned closer to 2B and advanced professional users. Continuous fiber 3D printing targets engineers, R&D teams, and performance-driven applications. The entry barrier — both technical and financial — is higher, and the initial customer pool is naturally smaller.

Different positioning leads to fundamentally different Kickstarter dynamics.

Pricing Shapes Backer Volume

Kickstarter backer counts are highly sensitive to price:

- Lower entry pricing encourages exploration and impulse support

- Higher pricing attracts fewer, more deliberate buyers

Snapmaker benefits from broader price accessibility, while FiberSeeker filters for specialized demand. High backer volume does not automatically indicate a “better” product — it often reflects who the product is built for.

What Country Distribution Tells Us

North America Is the Clear #1 Market

For both campaigns, North America — especially the United States — is dominant. This reflects:

- A mature maker and prosumer ecosystem

- Strong familiarity with Kickstarter

- Willingness to pre-pay for hardware innovation

Canada consistently appears as a strong secondary market, reinforcing North America’s leadership position.

Europe Is #2 — But Not a Single Market

Europe ranks second overall, but its internal behavior varies significantly. Germany stands out, particularly in the Snapmaker campaign. Germany demonstrates Strong professional and engineering adoption and A deep consumer maker culture at the same time

Notably, Berlin ranks as Snapmaker’s top city, indicating that Germany’s interest in 3D printing spans hobbyist, prosumer, and professional levels.

Other European countries — the UK, France, Netherlands, Italy, Spain — show stable but fragmented participation, influenced by language, purchasing culture, and localized marketing exposure.

Presence and Marketing Still Matter

One pattern is consistent across both campaigns:

Where a company has presence and visibility, results follow.

The strongest regions — the United States and Germany — are also the regions with:

- Higher advertising exposure

- More media coverage

- Stronger influencer and reviewer ecosystems

- Existing maker and engineering communities

Kickstarter does not create demand from nothing. It amplifies demand that already exists.

Is Kickstarter a Good Platform for 3D Printing Companies?

Yes — with realistic expectations.

Kickstarter aligns well with 3D printing because:

- Backers are tech-savvy and innovation-oriented

- Early adopters understand product development risk

- Many backers have purchasing power

However, funding is only one step. In most cases, Kickstarter capital goes directly into:

- OEM production

- Tooling

- Supply chain execution

It does not replace:

- Local distribution

- After-sales service

- Regional brand trust

The harder work begins after the campaign ends.

A More Cautious Backer Market

Recent campaigns show a more rational and cautious backer base. Launch announcements alone are no longer enough. Today’s backers increasingly rely on:

- Independent machine reviews

- Long-form YouTube testing

- Peer discussions

“Watch more machine reviews before you invest” has become a common mindset. As a result, social media and third-party validation now form a second critical pillar alongside Kickstarter itself.

Final Thought

Kickstarter is not a shortcut — it is a magnifier.

- It magnifies product positioning

- It magnifies market presence

- It magnifies execution quality

For 3D printing companies, long-term success depends less on launch headlines and more on sustained regional presence, user trust, and ecosystem building.

The longer the game, the happier the outcome.