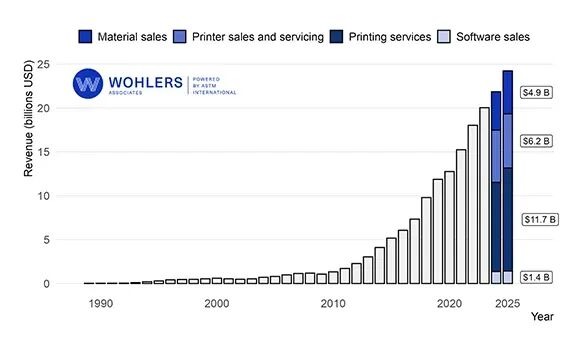

According to sources from 3Dzyk, on February 17, ASTM International released the Wohlers Report 2026 through its new digital platform. The report shows that the global additive manufacturing (AM) industry revenue reached $24.2 billion in 2025, representing a year-on-year growth of 10.9%.

The report indicates that while the industry continues to grow, the underlying logic of this growth is shifting: the market is becoming more mature, regional disparities are more pronounced, and the impact of policies and capital environments on the pace of technology adoption is deepening.

Specifically, the development of 3D printing is no longer following a single, uniform upward trajectory. Instead, it is gradually transitioning to a phase of “stable growth,” with greater emphasis on utilization rates, efficiency, and returns. Growth is becoming increasingly uneven across different regions and segments.

In terms of industry structure, services are becoming the primary driver of the market. According to the report, printing services account for 48% of the market share, equipment sales and related services make up 26%, materials represent 20%, and software constitutes 6%.

The report also shows that the 3D printing services sector maintained rapid growth in 2025, with an estimated year-on-year increase of 15.5%, while system sales grew by only 3.6%. This shift reflects a change in the focus of value creation within the industry: unlike the past, which relied on rapid hardware expansion, more growth is now coming from the production and delivery end. Companies are placing greater emphasis on unlocking actual output from existing installed capacity, improving capacity utilization, and expanding the production of end-use parts to realize returns on investment.

From a regional perspective, the report highlights that global growth is uneven. The average revenue growth rate for companies in the APAC region is 19.8%, compared to 12.6% in the Americas and 9.0% in Europe, the Middle East, and Africa (EMEA). The report suggests that these disparities underscore how regional policy directions, government investment levels, and manufacturing strategies are increasingly shaping the development landscape of additive manufacturing.

Overall, the signal from the Wohlers Report 2026 is that 3D printing remains on an upward trajectory, but the benchmark for industry competition is shifting from “selling more equipment” to “producing more qualified parts.” In this new cycle, those who can convert installed capacity into stable utilization rates and scalable deliveries will be more likely to achieve more certain growth in an environment of market divergence and tighter investment.

Editor: Li Chen

E: lichen@3dzyk.com